Bolt Threads, a biomaterials company that has made waves in the fashion industry with its sustainable materials, is taking a new step by planning a SPAC (Special Purpose Acquisition Company) deal at a valuation of $250 million.

A Sustainable Vision

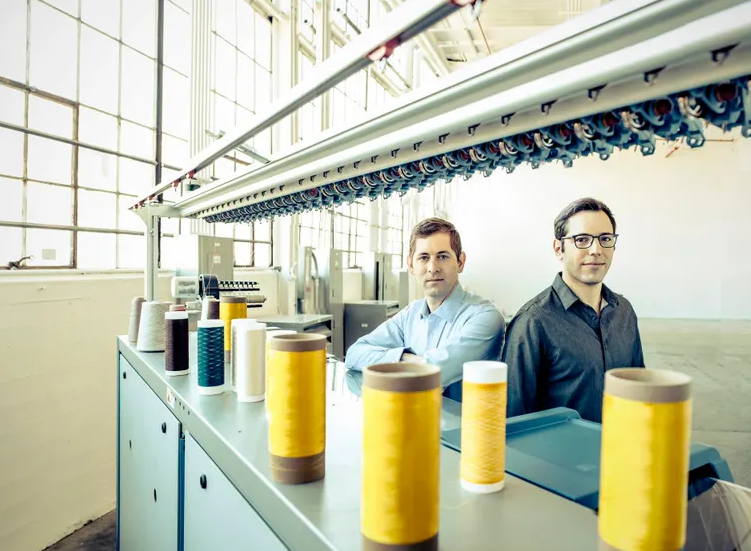

Bolt Threads, founded in 2009, is known for its innovative approach to biomaterials. The company specializes in creating sustainable alternatives to traditional materials like leather and silk. Their materials are bioengineered, using renewable resources and innovative technologies to reduce the environmental impact of fashion and textiles.

One of the company’s standout products is Microsilk, a bioengineered silk made by yeast fermentation, offering a cruelty-free and more sustainable alternative to traditional silk production. Bolt Threads has also ventured into creating a leather alternative called Mylo, which is made from mycelium, the root system of mushrooms.

The SPAC Deal

Bolt Threads’ decision to go public through a SPAC deal is a significant move for the company. The SPAC, under the name Thunderbridge Acquisition II, Ltd., is set to merge with Bolt Threads. The deal is expected to provide Bolt Threads with $200 million in gross proceeds, valuing the company at $250 million.

SPAC deals have become an increasingly popular way for companies to go public, providing them with quicker access to the stock market and often higher valuations than traditional IPOs. Bolt Threads’ choice to go public through a SPAC reflects its aspirations for growth and increased visibility in the market.

Sustainable Fashion’s Rising Profile

Bolt Threads’ decision to go public is in line with the growing interest and demand for sustainable fashion. Consumers are increasingly looking for environmentally responsible alternatives to traditional clothing and materials, and companies like Bolt Threads are well-positioned to meet this demand.

The fashion industry is one of the world’s largest polluters, and there is a pressing need for sustainable solutions. Bolt Threads has positioned itself as a pioneer in this space by offering innovative materials that reduce the industry’s reliance on resource-intensive and environmentally damaging processes.

Investor Confidence

The fact that Bolt Threads’ SPAC deal is valuing the company at $250 million suggests a significant level of investor confidence in the biomaterials firm. It demonstrates that investors see the potential for sustainable fashion and biomaterials to play a substantial role in the future of the fashion and textile industry.

Bolt Threads has garnered considerable attention and partnerships with prominent fashion brands and companies. Its innovations in biomaterials are seen as a promising solution to the environmental challenges that the fashion industry faces.

The Road Ahead

As Bolt Threads moves forward with its SPAC deal, the company is likely to use the funds raised to further expand its research and development, scale up production, and continue building partnerships with fashion brands. This could accelerate the adoption of sustainable biomaterials in the fashion industry, pushing the sector toward a more eco-friendly and responsible future.

In a world where sustainability is becoming a top priority for consumers and industries alike, Bolt Threads’ innovative approach to biomaterials could reshape the fashion landscape. As the company takes this significant step toward going public, it is poised to become a key player in the transition to a more sustainable and environmentally conscious fashion industry.